Early Bird Offer Ends SOON!

Master the System to Trade Confidently & Profitably in 60 days with AURUMFX Academy (January Intake)

The AURUMFX Mentorship Program is designed for traders who want to go beyond luck and to finally master a structured system that builds clarity, confidence, and consistency in every trade.

Over 60 days, you’ll learn how to read the market like a professional, manage risk with precision, and execute trade with confidence while being guided live, step by step, inside a private community built for serious traders.

REGISTRATION CLOSING IN

I finally understood how to read market structure properly, went from random trades to consistent profits.

- Sarveen

Rhuthran’s mentorship changed how I look at charts. Made back my full fee within 6 weeks of trading.

- Adrian

I joined confused, left with a trading system I actually trust. Best investment I’ve made in my journey.

- Malar

AURUMFX Mentorship Framework

SYSTEM

Trading success isn’t luck it’s structure. Inside this mentorship, you’ll learn how to build a complete trading system that fits your personality and time availability. From identifying key zones to spotting high-probability setups, you’ll know exactly what to look for and when to strike.

EXECUTION

Knowing your setup means nothing if you can’t execute it. You’ll learn how to enter trades with conviction, manage risk intelligently, and journal your decisions like a professional. By the end of the program, hesitation turns into precision and confidence becomes your default state.

MINDSET

Most traders lose not because of poor strategy, but poor discipline. Here, you’ll learn how to manage emotions, avoid revenge trades, and stay grounded through winning and losing streaks. You’ll train your mindset to think like a professional, not a gambler because mastery starts in your head before it shows in your account.

What You’ll Learn Inside the

AURUMFX Mentorship

Module 1: Session Trading

Mastering the Flow of the Market

Every session Asian, London, and New York moves differently.

You’ll learn when volume spikes, how market shifts, and which setups perform best in each session.

Once you understand session behavior, you’ll never get caught trading during dead hours again.

Module 2: The Trading Day

Anticipating Daily Direction

Each day has its own rhythm and once you understand that rhythm, you can predict its likely path.

Learn how to measure daily volume, identify key directional bias, and anticipate how the market is likely to move before it happens.

This is how professional traders plan their day.

Module 3: Market Movement

The Only 3 Ways Price Moves

Markets move in patterns and once you see them, you can’t unsee them.

You’ll learn to identify each market phase, understand what’s driving it, and apply a tested framework (your “cheat code”) to stay on the right side of every move.

Module 4: Trend Trading

Knowing When to Attack and When to Wait

Not every market should be traded the same way. This module teaches you how to differentiate between trending and consolidating environments so you know when to trade aggressively and when to step back.

It’s the key to improving your win rate while protecting your capital.

Module 5: Confirmation

Timing Entries with Precision

Finding a zone is easy. Entering at the right moment isn’t. You’ll learn how to identify confirmation signals that show real intent in the market — eliminating doubt, hesitation, and unnecessary layering.

By the end of this module, you’ll know exactly when to pull the trigger.

Module 6: Risk Management

Protecting Capital Like a Pro

Every trader talks about risk management, but few actually apply it properly.

You’ll learn how to calculate your personal risk threshold based on your psychology, not someone else’s formula so trading never feels stressful or impulsive again.

Module 7: Trade Management

Turning Good Entries into Great Results

You’ve seen it being up 50 pips, only to end in a loss.

In this final module, you’ll learn dynamic trade management techniques: scaling out, locking profits, and reducing exposure as the market moves.

This is the difference between trading well and trading professionally.

Exclusive Bonuses for January Intake Students

🎁 Bonus #1

1-on-1 Strategy Review Session

Once you reach Level 2 in private community you’ll unlock a private 30-minute strategy session with Rhuthran. We’ll review your trading system, identify blind spots, and fine tune your approach for peak performance.

🎁 Bonus #2

Lifetime Access to AURUMFX Portal

No deadlines. No expirations.

You’ll receive permanent access to every recorded lesson, future update, and new module. Trading mastery takes time you’ll always be able to revisit and refine at your own pace.

🎁 Bonus #3

Private Trader Community

Join a network of traders who actually put in the work.

Inside the AURUMFX private group, members share trade ideas, daily analyses, and results keeping you accountable, motivated, and constantly improving.

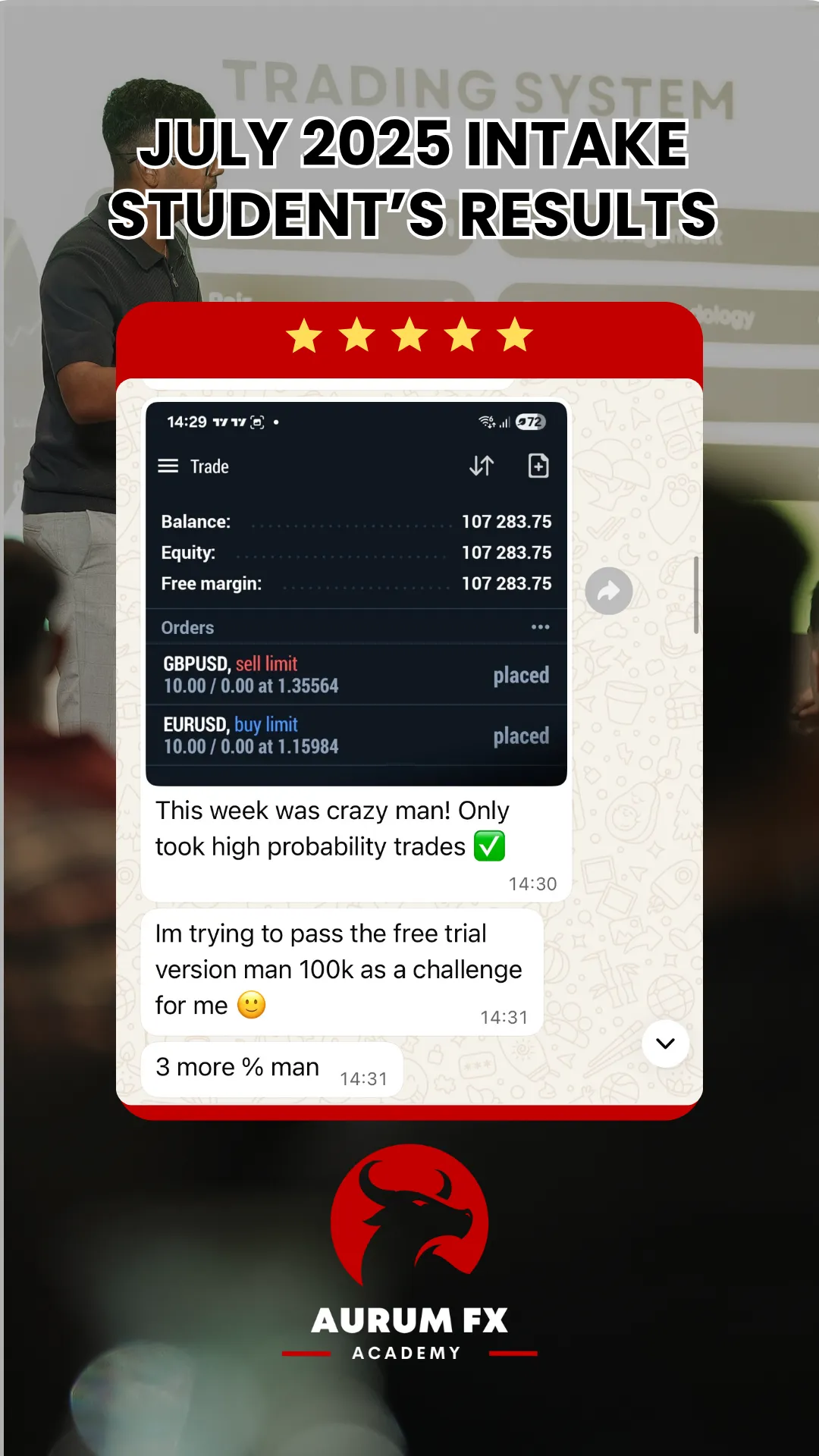

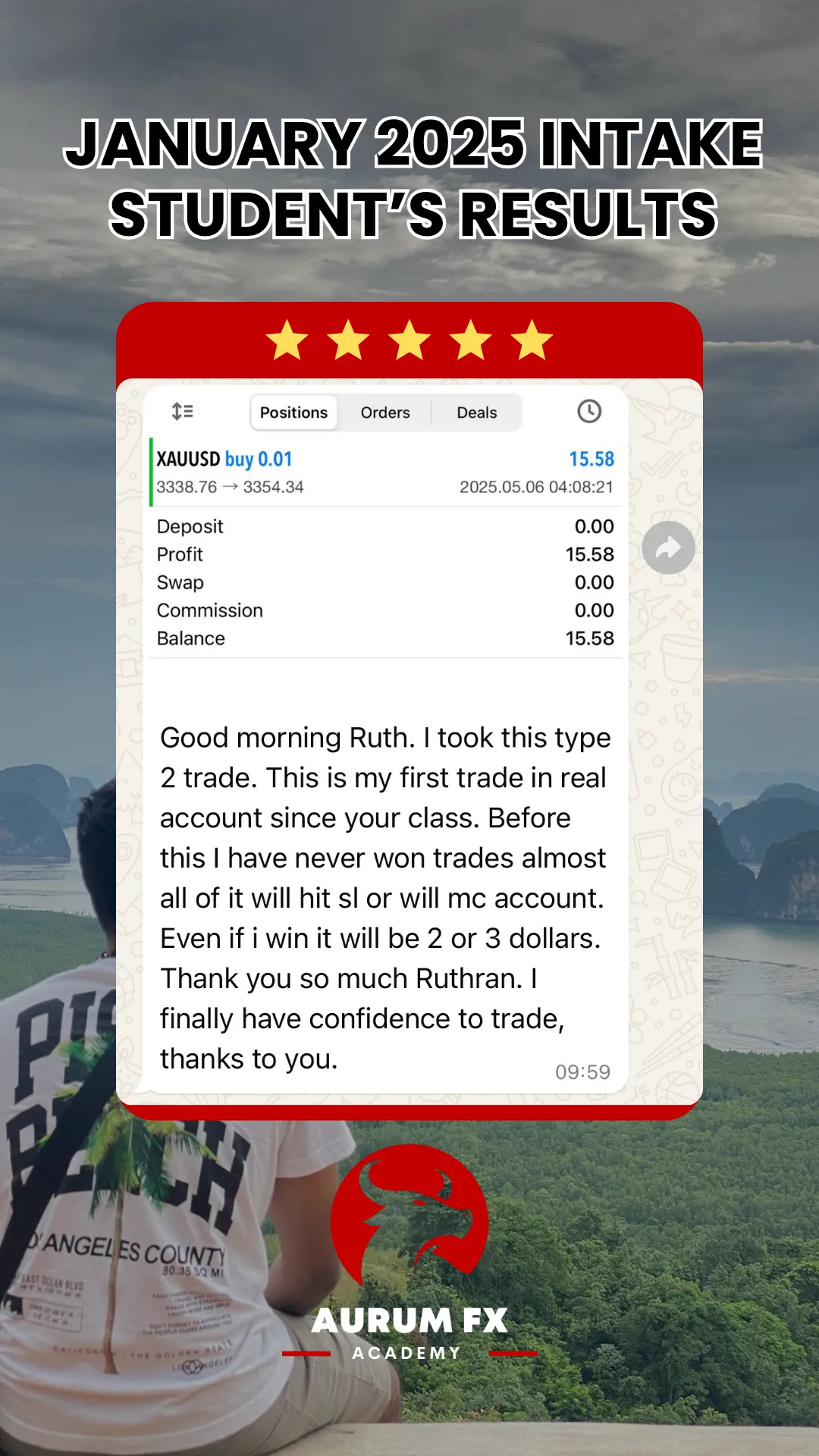

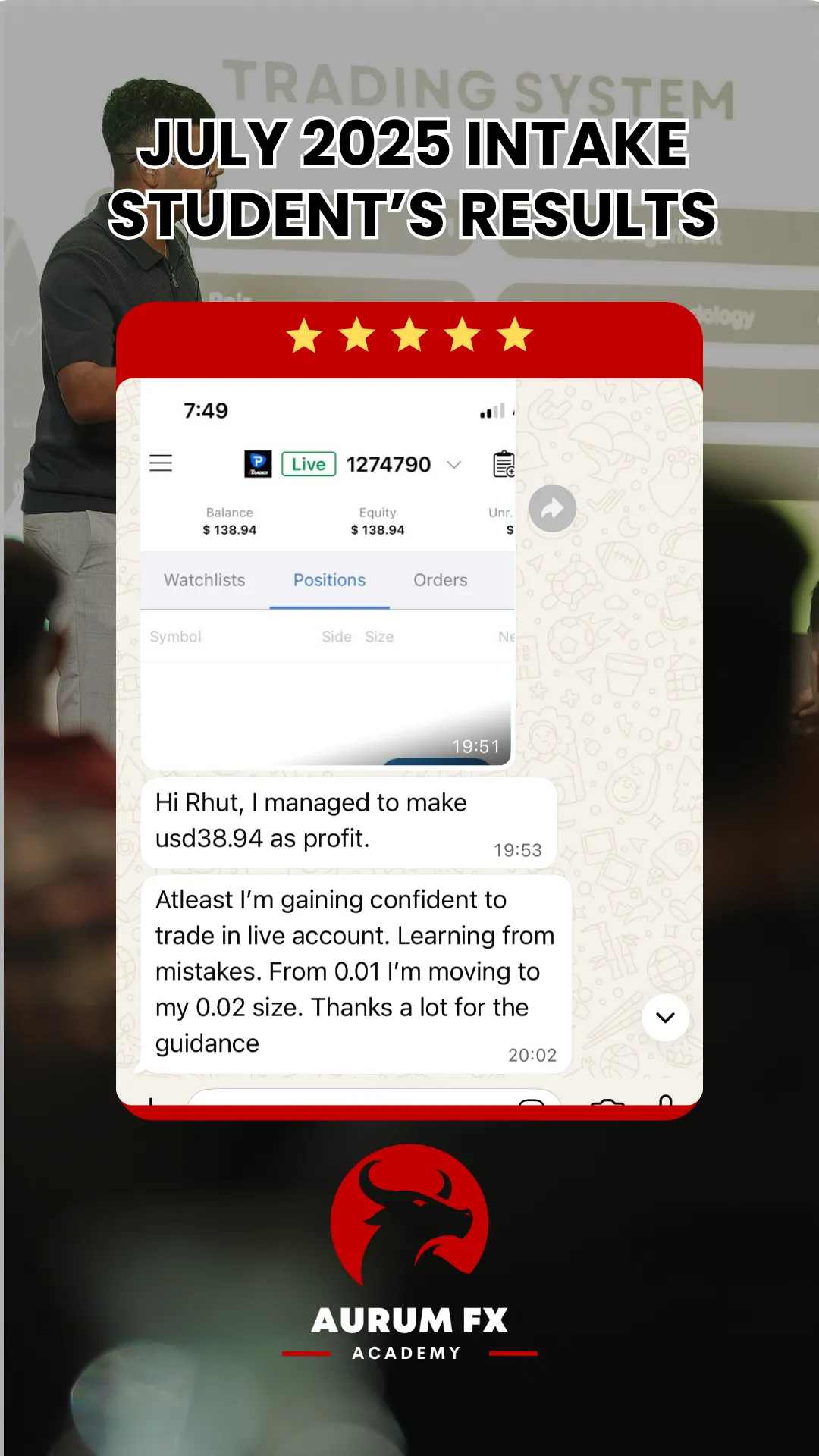

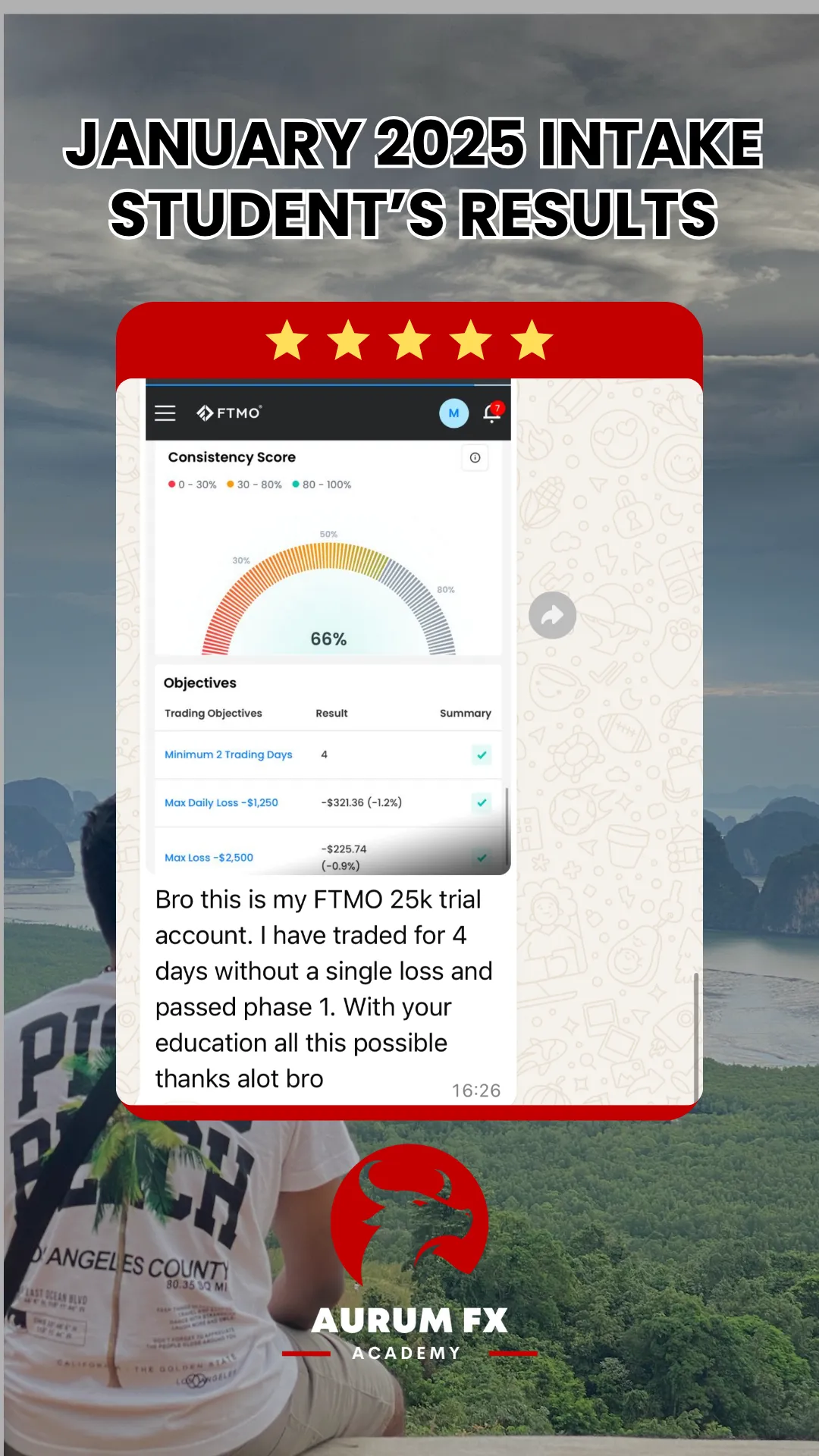

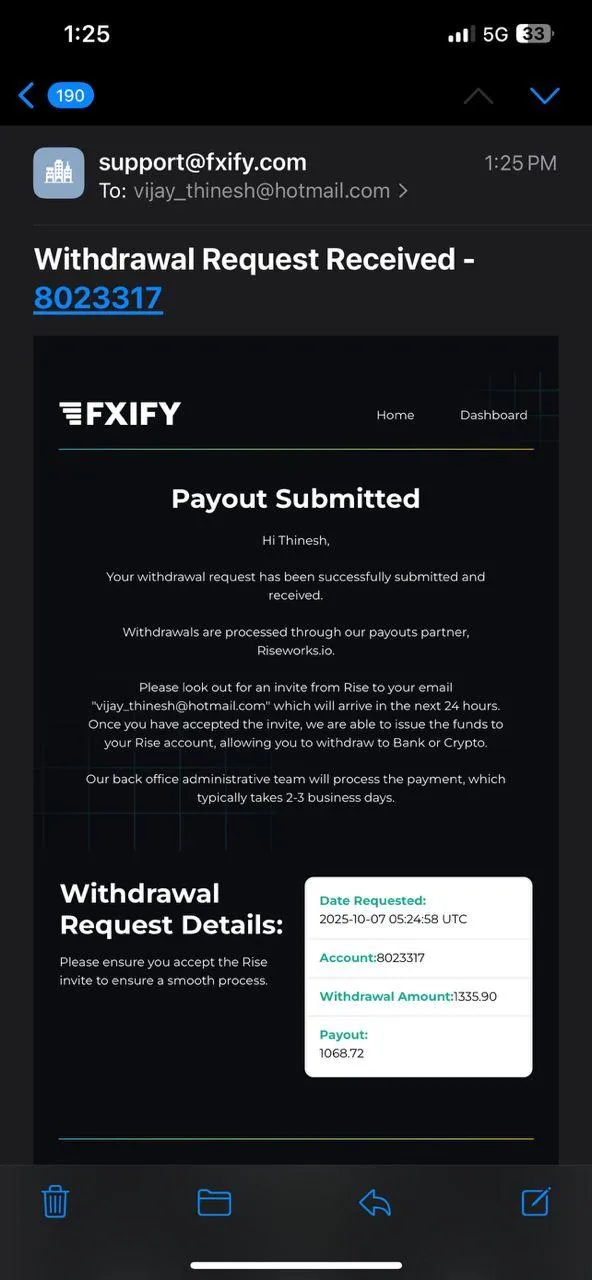

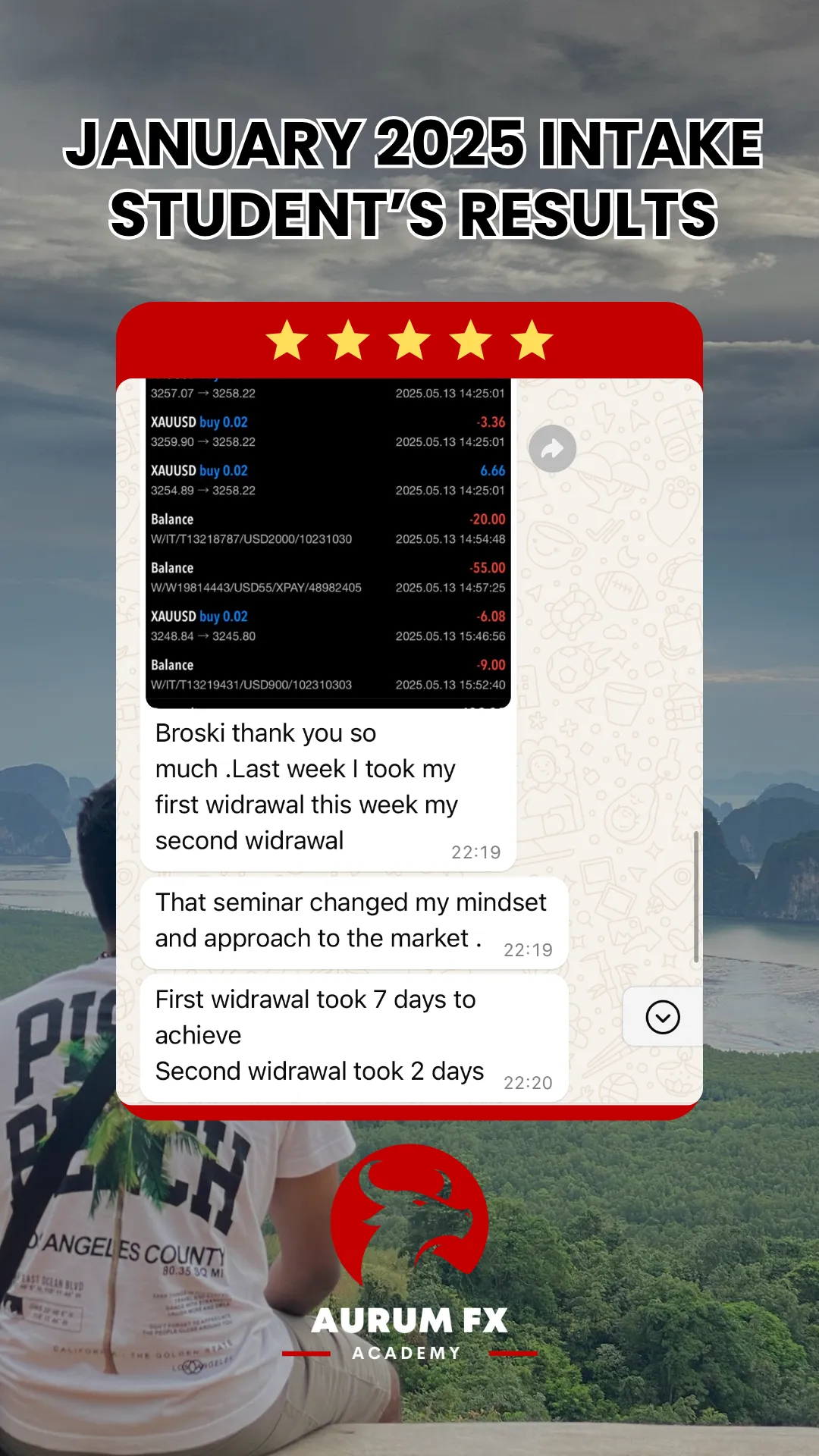

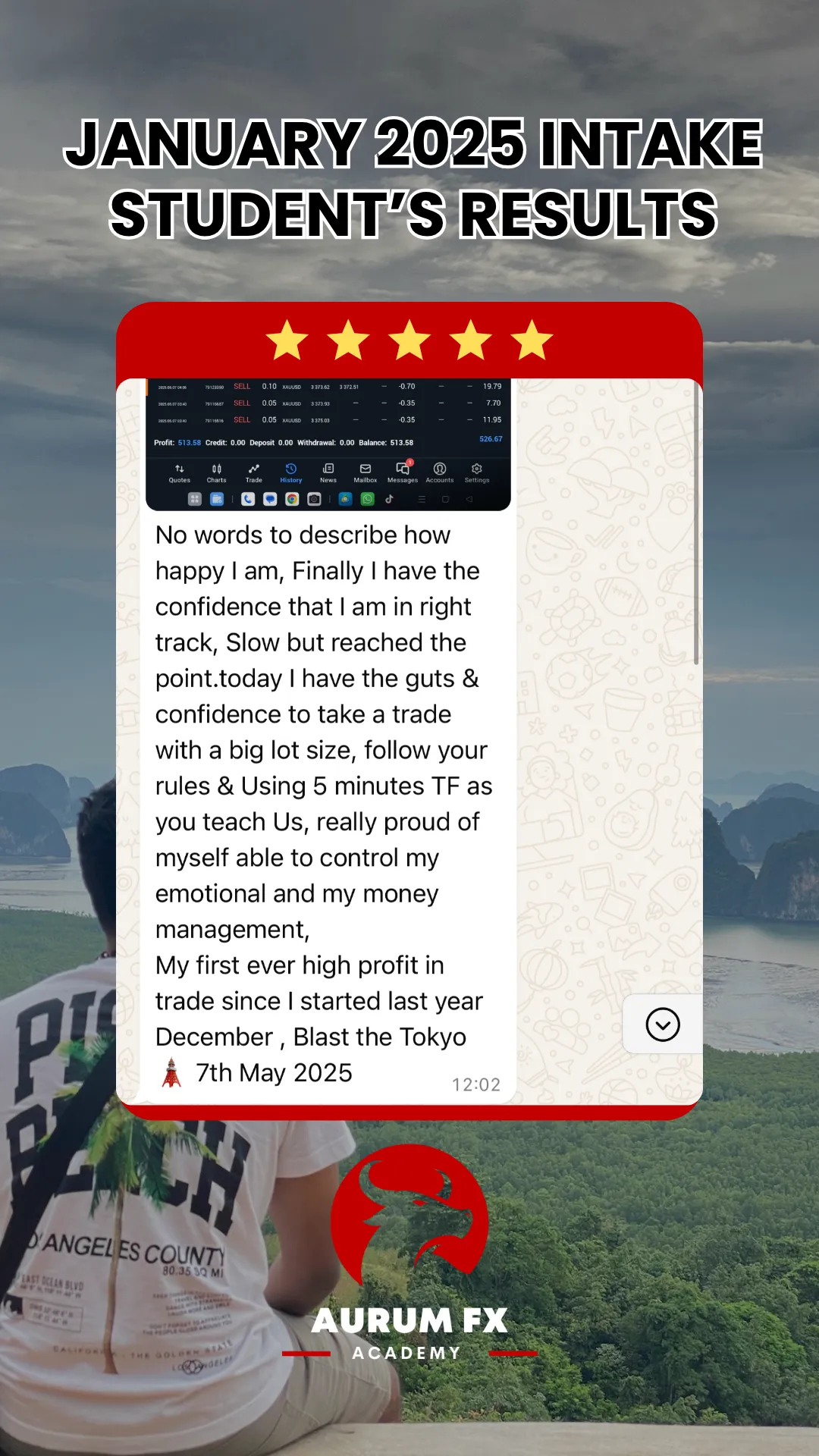

Real Results from

Real Traders

Meet Your Instructor

I started trading back in 2018 with just $250 borrowed money at the time.

Like most traders, I blew accounts, kept changing strategies, and chased every “secret indicator” that promised success.

None of it worked.

What finally changed everything was when I stopped chasing shortcuts and started learning how the market actually moves through sessions, liquidity, and structure.

That’s when I found consistency.

Today I’ve:

➡️ Scaled multiple accounts and made seven figure withdrawals

➡️ Mentored hundreds of traders worldwide

➡️ Built the AURUMFX community where traders grow together

➡️ Founded ARC Funding, a prop firm that funds traders globally

➡️ Ranked Top 5 in the World Trading Championship (Q3 2025)

➡️ Received the Asia Excellence Choice Award 2025 as an Inspiring Trader and Entrepreneur

And here’s the biggest truth I’ve learned.

Trading success doesn’t come from signals or luck. It comes from structure, repetition, and proper mentorship.

That’s why I created the AURUMFX Mentorship Program to help traders understand the market, manage risk, and trade confidently.

No confusion. No guessing. No emotional trading.

Inside the program you’ll learn the exact frameworks I use daily on how to spot high probability setups, align with market phases, and execute like a professional.

You’ll also be part of a strong community with live sessions, Q&As, and full support so you never trade alone again.

I’ve seen students start with doubt and end up managing funded accounts confidently.

If you’re ready to master trading and finally stay consistent, I’d love to guide you personally.

Your journey to becoming a consistent trader starts here. 🚀

Frequently Asked Questions

How long do I have access to the program & when does it start?

You’ll get lifetime access to all mentorship recordings, community discussions, and future updates. Every live session is recorded and uploaded to your student portal so you can rewatch anytime. You’ll also join our private group to share ideas, ask questions, and get feedback so your learning continues even after the program ends.

Can't I learn all of this on Youtube?

You can learn bits and pieces from YouTube, but it gives you information, not structure. You’ll find hundreds of strategies that contradict each other and end up confused. Inside this mentorship, everything is taught step by step with live guidance, feedback, and a community something you’ll never get from random videos online.

Do I need to have experience before starting?

No experience needed. The Beginner’s Guide covers everything from what trading is to opening accounts, using MT4/MT5, and managing risk. After that, we’ll move into advanced systems, market structure, and session strategies helping you grow from complete beginner to confident trader. All you need is a laptop, internet, and the right mindset.

© 2025 AURUMFX VENTURES

By visiting this page, you agree to terms and conditions, privacy policy & earnings disclaimer.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.